Blue: Smart Assistant

Team

Company | Institution

Category

Type

Project description

To continue innovating our banking mobile application experience, we designed "Blue," a virtual assistant that enables financial transactions to be made by voice and text. Thanks to this experience, we can provide closer assistance and self-service to 10.7 M people.The users of BBVA are very diverse, both in terms of age, income, and experience with technology. Blue allows them to interact through a chat window in the application with voice and text, enabling new forms of usage to decide which is best for them.We had a great challenge because it was necessary to consider the linguistic variety of our country and design the training of the AI and the conversations that would impact the vast majority of the users, regardless of their social, educational, or geographical conditions.

Overview

To continue innovating our banking mobile application experience, we designed “Blue,” a virtual assistant that enables financial transactions to be made by voice and text. Thanks to this experience, we can provide closer assistance and self-service to 10.7 M people.

The users of BBVA are very diverse, both in terms of age, income, and experience with technology. Blue allows them to interact through a chat window in the application with voice and text, enabling new forms of usage to decide which is best for them.

We had a great challenge because it was necessary to consider the linguistic variety of our country and design the training of the AI and the conversations that would impact the vast majority of the users, regardless of their social, educational, or geographical conditions.

Context

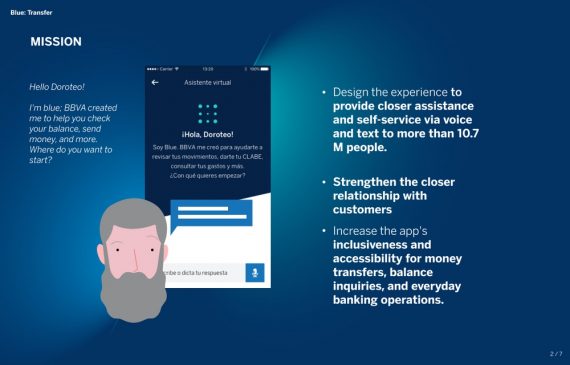

Design the experience to provide closer assistance and self-service via voice and text to more than 10.7 M people.

Strengthen the closer relationship with customers.

Increase the app’s inclusiveness and accessibility for money transfers, balance inquiries, and everyday banking operations.

Process

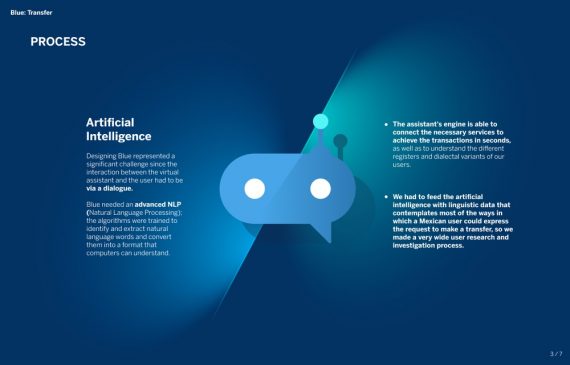

Designing Blue represented a significant challenge since the interaction between the virtual assistant and the user had to be via a dialogue.

Blue needed an advanced NLP (Natural Language Processing); the algorithms were trained to identify and extract natural language words and convert them into a format that computers can understand.

Blue can make a transfer with a single user instruction containing all the necessary information: source account, destination account, and the amount.

We first had extensive field research to understand how Spanish is spoken across Mexico’s 1.973 million km² to design the conversations, user flows, and training.

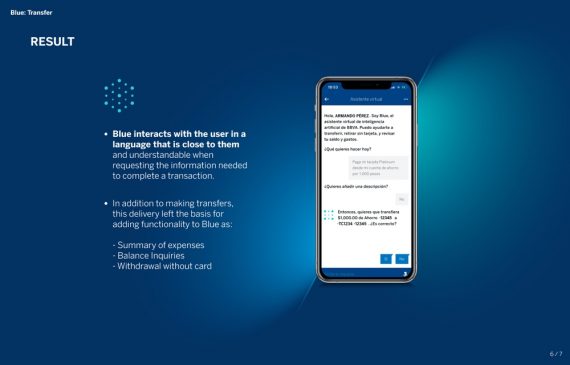

We analyzed the users’ forms of expressions, we discovered for example, that when they ask for a transfer, they say the destination account and the amount they want to transfer.

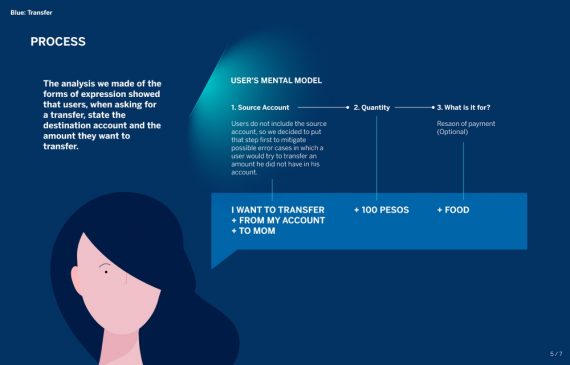

Blue interacts with the user in a language that is close to them and understandable when requesting the information needed to complete a transaction.

In addition to making transfers, this delivery left the basis for adding functionality to Blue as:

– Summary of expenses

– Balance Inquiries

– Withdrawal without card

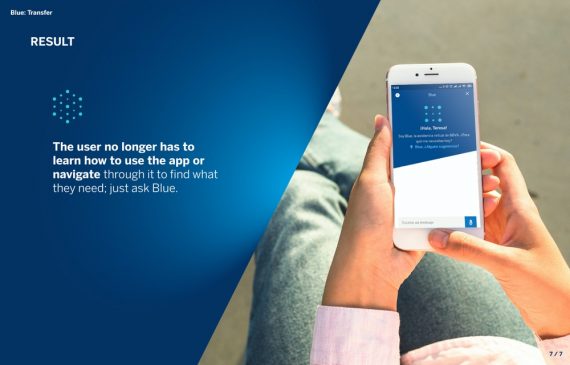

The user no longer has to learn how to use the app or navigate through it to find what they need; just ask Blue.

Overview

To continue innovating our banking mobile application experience, we designed “Blue,” a virtual assistant that enables financial transactions to be made by voice and text. Thanks to this experience, we can provide closer assistance and self-service to 10.7 M people.

The users of BBVA are very diverse, both in terms of age, income, and experience with technology. Blue allows them to interact through a chat window in the application with voice and text, enabling new forms of usage to decide which is best for them.

We had a great challenge because it was necessary to consider the linguistic variety of our country and design the training of the AI and the conversations that would impact the vast majority of the users, regardless of their social, educational, or geographical conditions.

Context

Design the experience to provide closer assistance and self-service via voice and text to more than 10.7 M people.

Strengthen the closer relationship with customers.

Increase the app’s inclusiveness and accessibility for money transfers, balance inquiries, and everyday banking operations.

Process

Designing Blue represented a significant challenge since the interaction between the virtual assistant and the user had to be via a dialogue.

Blue needed an advanced NLP (Natural Language Processing); the algorithms were trained to identify and extract natural language words and convert them into a format that computers can understand.

Blue can make a transfer with a single user instruction containing all the necessary information: source account, destination account, and the amount.

We first had extensive field research to understand how Spanish is spoken across Mexico’s 1.973 million km² to design the conversations, user flows, and training.

We analyzed the users’ forms of expressions, we discovered for example, that when they ask for a transfer, they say the destination account and the amount they want to transfer.

Blue interacts with the user in a language that is close to them and understandable when requesting the information needed to complete a transaction.

In addition to making transfers, this delivery left the basis for adding functionality to Blue as:

– Summary of expenses

– Balance Inquiries

– Withdrawal without card

The user no longer has to learn how to use the app or navigate through it to find what they need; just ask Blue.