CBDCs for SDGs

Team

Company | Institution

Category

Type

Project description

CBDCs for SDGs is a master’s thesis exploring ‘central bank digital currency’ (CBDCs), an emerging technology currently researched by 90% of the world’s central banks. Explained simply, one could think of it as a digital alternative to the physical cash produced by central banks, a public alternative to the electronic money in our private banks, or as a crypto-inspired national digital currency. Through strategic design, the project shows how CBDCs could enable new kinds of policies to achieve ‘the sustainable development goals’ (SDGs) in Norway.

90% of the world’s central banks are researching how CBDCs could make the monetary system more efficient. Simultaneously, the UN panel on climate change calls for cross-sectoral action with all possible means. Thirdly, to the Norwegian government, “public sector innovation is one of our main strategies to solve the big societal challenges”. The thesis thus aimed to act as a white paper on behalf of The Norwegian Central Bank exploring innovation opportunities concerning CBDCs and SDGs. As the central bank’s working group on the topic had no prior knowledge about design methods, demonstrating the value of design for central banking was also an important goal.

The design process was characterized by continuous dialogue with the central bank and 24 experts in economics, fintech, and policy, with synthesis and sketching in-between. A key insight was learning that political independence has been an important central banking principle for over fifty years. Thus, the central bank’s current mandate focuses solely on financial stability and efficiency. However, as research uncovers the interconnectedness between the effects of climate change and financial stability, addressing climate change could actually fall under the current mandate.

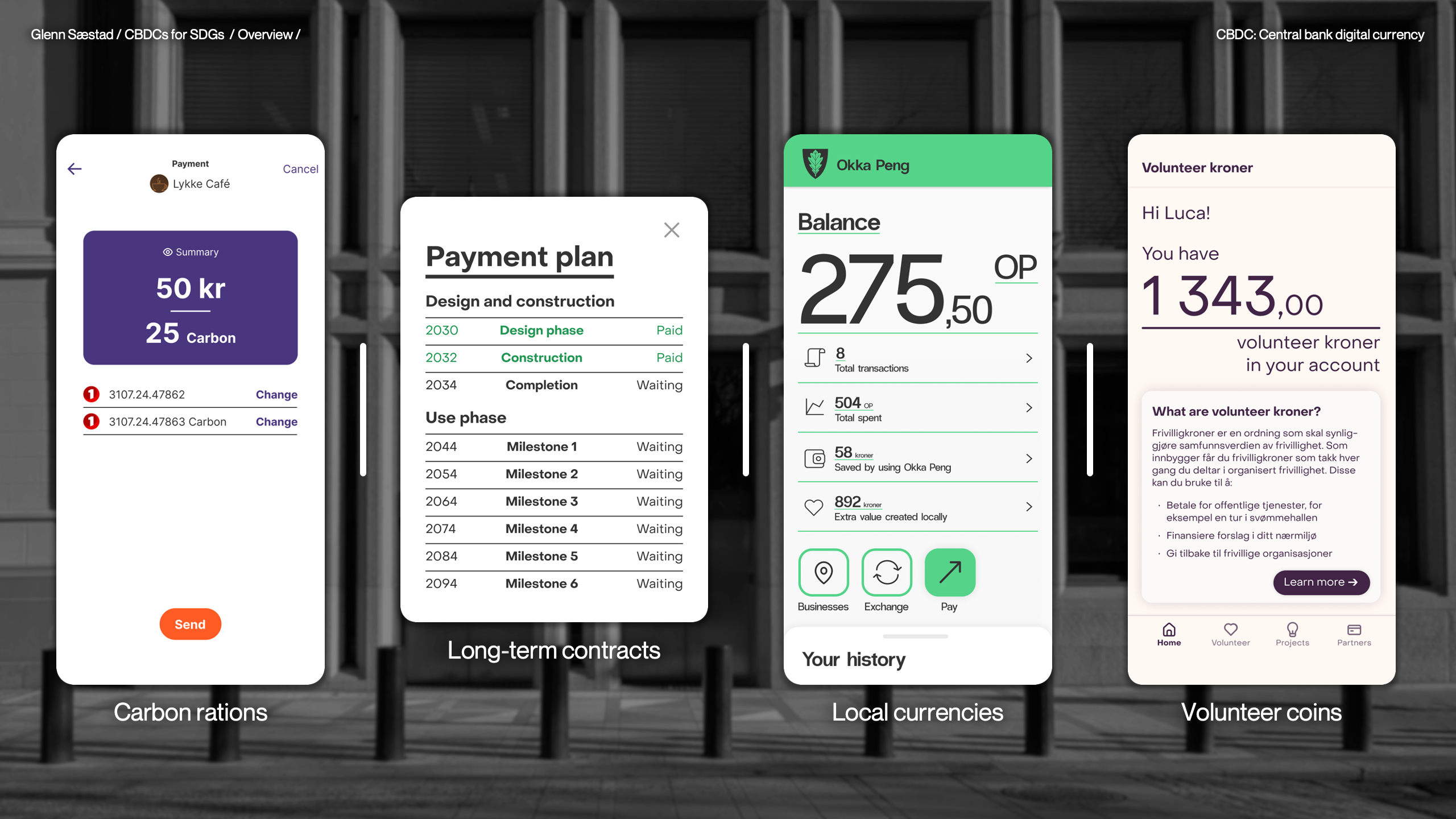

The insights pointed to a future scenario asking, “What if all of public sector could build services on top of a CBDC infrastructure?” This exercise resulted in 14 concepts, which the experts rated and discussed. The delivery, an alternative strategic vision, consists of the most interesting concepts challenging the central bank’s current approach to CBDC:

- Carbon rations: A system rationing emisissions for fair consumption.

- Long-term contracts: Locking funds from public construction procurements until milestones throughout buildings’ life cycles.

- Local currency: The possibility for municipalities to launch their own currencies with limitations and benefits based on local needs.

- Volunteer currency: A currency for public-volunteer collaboration where organized volunteering participants get currency for public services and financing municipal neighborhood projects suggested by other citizens.

The delivery also includes strategic principles based on insights from developing the examples. The principles call for better collaboration with other parts of government, so that they can develop innovative and holistic policies. This will enable a diversity of central bank currencies for different goals, managed by different parts of government.

This thesis is not about the design examples themselves but highlighting an understudied direction for CBDCs challenging the central bank’s approach to innovation. Adopting the SDGs would generate great impact outside of the central bank. Government would gain a new digital infrastructure for achieving the SDGs, creating value for citizens by transitioning into a more sustainable and stable society faster. The central bank could thus live up to society’s expectations of contributing to sustainable development without breaking central bank independence. CBDCs serving more needs would also increase the willingness to invest in this complex new technology.

To validate the value of the project, both the central bank and Rethinking Economics reviewed the results. While the two often oppose each other on economic policy, both were intrigued by the ideas, showing how the project mediates between conventional and radical economic theory.

90% of the world’s central banks are researching how CBDCs could make the monetary system more efficient. Simultaneously, the UN panel on climate change calls for cross-sectoral action with all possible means. Thirdly, to the Norwegian government, “public sector innovation is one of our main strategies to solve the big societal challenges”. The thesis thus aimed to act as a white paper on behalf of The Norwegian Central Bank exploring innovation opportunities concerning CBDCs and SDGs. As the central bank’s working group on the topic had no prior knowledge about design methods, demonstrating the value of design for central banking was also an important goal.

The design process was characterized by continuous dialogue with the central bank and 24 experts in economics, fintech, and policy, with synthesis and sketching in-between. A key insight was learning that political independence has been an important central banking principle for over fifty years. Thus, the central bank’s current mandate focuses solely on financial stability and efficiency. However, as research uncovers the interconnectedness between the effects of climate change and financial stability, addressing climate change could actually fall under the current mandate.

The insights pointed to a future scenario asking, “What if all of public sector could build services on top of a CBDC infrastructure?” This exercise resulted in 14 concepts, which the experts rated and discussed. The delivery, an alternative strategic vision, consists of the most interesting concepts challenging the central bank’s current approach to CBDC:

- Carbon rations: A system rationing emisissions for fair consumption.

- Long-term contracts: Locking funds from public construction procurements until milestones throughout buildings’ life cycles.

- Local currency: The possibility for municipalities to launch their own currencies with limitations and benefits based on local needs.

- Volunteer currency: A currency for public-volunteer collaboration where organized volunteering participants get currency for public services and financing municipal neighborhood projects suggested by other citizens.

The delivery also includes strategic principles based on insights from developing the examples. The principles call for better collaboration with other parts of government, so that they can develop innovative and holistic policies. This will enable a diversity of central bank currencies for different goals, managed by different parts of government.

This thesis is not about the design examples themselves but highlighting an understudied direction for CBDCs challenging the central bank’s approach to innovation. Adopting the SDGs would generate great impact outside of the central bank. Government would gain a new digital infrastructure for achieving the SDGs, creating value for citizens by transitioning into a more sustainable and stable society faster. The central bank could thus live up to society’s expectations of contributing to sustainable development without breaking central bank independence. CBDCs serving more needs would also increase the willingness to invest in this complex new technology.

To validate the value of the project, both the central bank and Rethinking Economics reviewed the results. While the two often oppose each other on economic policy, both were intrigued by the ideas, showing how the project mediates between conventional and radical economic theory.